For the purpose of unemployment security, any and all work not performed in a private or public employment relationship is considered business activities. Ownership or formal position has no relevance. If you work through a billing cooperative, for instance, you are an entrepreneur as far as unemployment security is concerned.

For the purpose of unemployment security, entrepreneurship may be a primary or a secondary occupation. If entrepreneurship is your secondary occupation, you may be entitled to earnings-related daily allowance. The evaluation of whether your entrepreneurship is a primary or secondary occupation is made by the employment authority, which will issue a binding labour market policy statement on your entrepreneurship to the KOKO unemployment fund.

However, even if you are considered an entrepreneur for the purpose of unemployment security, you can still accrue the employee’s employment condition in other work. Work done as an entrepreneur does not accrue your employment condition, regardless of whether entrepreneurship is your primary or secondary occupation. Simply fulfilling the definition of an entrepreneur does not make you a full-time entrepreneur or remove your entitlement to a wage earner’s daily allowance.

You must notify the employment authority of all your business activities. The notification obligation applies to agriculture, forestry, start-up enterprises and business activities begun before you became unemployed.

The concept of ‘entrepreneur’ for the purpose of unemployment security may be defined differently than in pensions legislation. This causes discrepancies, For instance, when under pensions legislation you do not need entrepreneur’s employment pension insurance (YEL) or agricultural entrepreneur’s employment pension insurance (MYEL), but for the purpose of unemployment security you may nevertheless be deemed an entrepreneur.

Under unemployment security, you may be deemed an entrepreneur in the following cases

- You have YEL or MYEL insurance

- as a private entrepreneur (self-employed person or private trader, proprietorship),

- as an agricultural entrepreneur,

- as partner in a general partnership, or

- the general partner in a limited partnership.

- You are in a managerial position in a limited liability company where

- you yourself have a holding of 15% or more, or

- you and your family together, have a holding of 30% or more.

- You are employed in a limited liability company where

- you yourself have a holding of 50% or more, or

- you and your family together, have a holding of 50% or more.

- You are working but not in a private or public employment relationship, regardless of what your holdings and position may be.

- You serve on the board of directors of a corporation for profit and you receive, for example, attendance fees.

Holdings are calculated taking into account the votes vested in shares or similar decision-making powers. You are considered to be in a managerial position if you are a managing director, a member of the board of directors or a similar officer.

Starting an entrepreneurship as an unemployed person

Starting a business as an entrepreneur, whilst you are unemployed, will not prevent you receiving the daily allowance during the first four months from starting the business. Income from your entrepreneurial business is adjusted, i.e. the income you receive reduces the amount of daily allowance you are entitled to, as does income from other employment.

During the first four months, the employment authority will not assess whether your business is primary or secondary employment. After the four months, the employment authority will evaluate how much your business is employing you. If your activity is judged as a secondary employment, you may continue to receive the daily allowance. However, if your activity is judged to be your primary employment, after the four month period, you will no longer receive daily allowance from the Unemployment Fund.

Entrepreneurship as a secondary occupation

You may be entitled to adjusted earnings-related unemployment allowance if the employment authority considers that your entrepreneurship is a secondary occupation. The employment authority evaluates the scope of the business primarily based on the workload. A low level of income from business alone is therefore not decisive.

Earned income from part-time business activities is taken into account when paying the earnings-related unemployment allowance. The KOKO fund independently evaluates your entrepreneurship status as regards payment of adjusted earnings-related daily allowance.

Entrepreneurship as a primary occupation

If the employment authority considers that entrepreneurship is your primary occupation, you are not entitled to receive earnings-related daily allowance from KOKO. Generally, entrepreneurship is considered a primary occupation if the work commitment is so great that it would prevent you from accepting a full-time job.

If entrepreneurship is your primary occupation as defined in the Unemployment Security Act, you should consider joining another unemployment fund. Entrepreneurs may turn for instance to the Yrittäjäkassa (former SYT). Read more: Beginning full-time business activities

Beginning entrepreneurship

When you start a business as an unemployed person, the employment authority will not evaluate whether you are a part-time or a full-time entrepreneur for the first 4 months. This means that you are entitled to earnings-related allowance for at least 4 months since starting your business.

Please contact employment authority prior to becoming an entrepreneur, because they will examine the starting and ending dates of entrepreneurship. If you receive income from your business activities within the first 4 months, the earnings-related allowance will be paid adjusted. You must apply for a full-time job even during your 4-month period of entrepreneurship.

After the 4-month period has passed, the employment authority will evaluate whether you are a part-time or a full-time entrepreneur and give your unemployment fund a statement regarding the matter.

Short-term business activities

If you are engaged in business activities that last for no longer than 2 weeks, the employment authority will not issue a statement on entrepreneurship; instead, KOKO will investigate your business activities on the basis of data you supply. Submit a report on your business activities and your income from them to KOKO; you may be entitled to adjusted earnings-related daily allowance for the duration of your short-term business activities. Assignments and jobs done through a billing cooperative are typical examples of short-term business activities.

If your business activities last for more than 2 weeks, the fund will ask the employment authority for a statement. The employment authority will investigate and return a statement, and your entitlement to earnings-related daily allowance will be determined on the basis of that statement.

Unemployment security of family members working in family businesses

Family members working in a family business will be considered salaried employees as of 1 July 2019, if they do not hold ownership or control in the company. The following are considered as the entrepreneur’s family members: spouse (also cohabitee) and any person related to the entrepreneur and living in the same household (parents, grandparents, children, grandchildren).

The employment condition of an entrepreneur’s family member as a salaried employee will be fulfilled after having been a member of a salaried employees’ fund in a non-owning position for at least 12 months, and at least 52 calendar weeks within 28 months have been accumulated towards the employment condition while working in the family company.

The other criteria for the employment condition with regard to working hours and wages, for example, are the same as those applied to other salaried employees until 1 September 2024. However, the employment condition of an entrepreneur’s family member cannot be combined with the employment condition accumulated as an entrepreneur or other employment condition accumulated as a salaried employee.

As of 2 September 2024, the employment condition and membership conditions of a family member who works for a family company will change. In practice, however, the new act will not be applied until autumn 2025, since the employment condition for those working in a family business remains earnings-based and per calendar week, if the employment condition is met in compliance with the old act even for one week. Until then, the old rules in force until 1 September 2024 will be observed.

According to the new act, non-owning family members are subject to the same employment condition as other salaried employees, i.e. the 12 calendar month employment condition.

If you own more than 0% of your family’s business, you are considered an entrepreneur in the unemployment security. As entrepreneurs are also considered people who work in a family-owned proprietorship (and thus, are always considered as entrepreneurs in the pension system, i.e. they are YEL insured).

Example

Example

Example

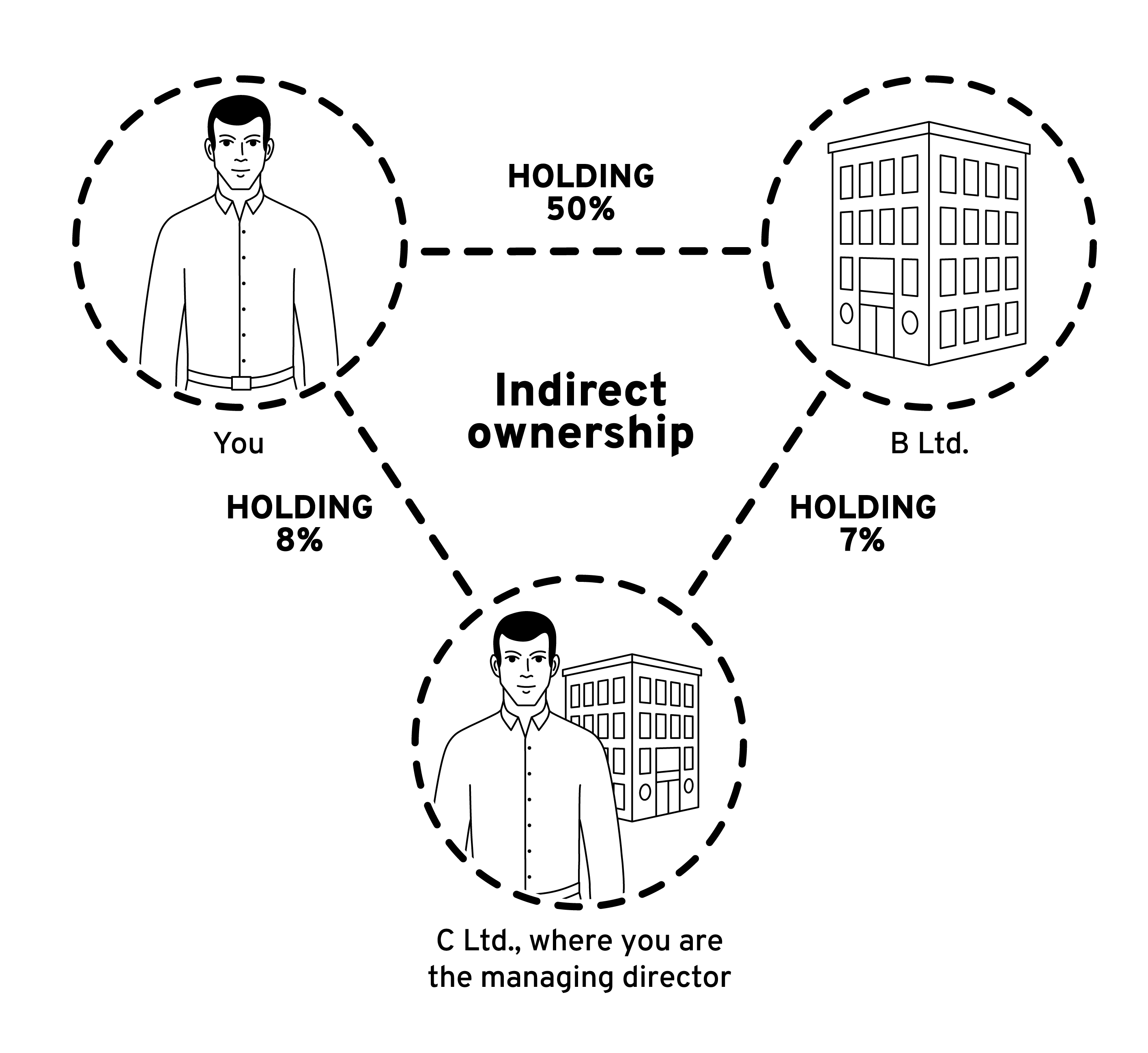

Indirect ownership

Indirect ownership through another enterprise or corporation is also considered when calculating holdings. Ownership is indirect if you or your family or both have a combined holding of 50% or more in the intermediary body.

Example